Capital Gains Distribution Definition - Investopedia.

Capital gains tax can effect economic growth, when the tax rate is high investment will decrease however the opposite will occur when the tax rate is low, the benefit of this is that the government can therefore use capital gains tax to influence behaviour.Capital gains and losses are said to be short-term if the holding period is one year or less. If the holding period of capital gains or losses exceeds one year, the capital gain is considered to be long-term (Hammer, 2013). The instructions about short-term and long-term capital gains are laid down in Form 8949 of the U. S. tax codes and.Life in college is filled with joy and excitement. But it also has homework writing assignments in almost any course. If doing endless amounts of essays and research papers grinds your gears, Essay Capital will help you make some capital gains in the score sheet department.

Disclaimer: This work has been submitted by a student. This is not an example of the work produced by our Essay Writing Service.You can view samples of our professional work here. Any opinions, findings, conclusions or recommendations expressed in this material are those of the authors and do not necessarily reflect the views of UK Essays.The provision relates to the disposal of assets, and it considers “any capital sum which is derived from assets notwithstanding that no asset is acquired by the person paying the capital sum,” (1) (emphasis added) as a disposal of asset for the purposes of capital gains tax. Capital sum is defied as any money or money’s worth which is not.

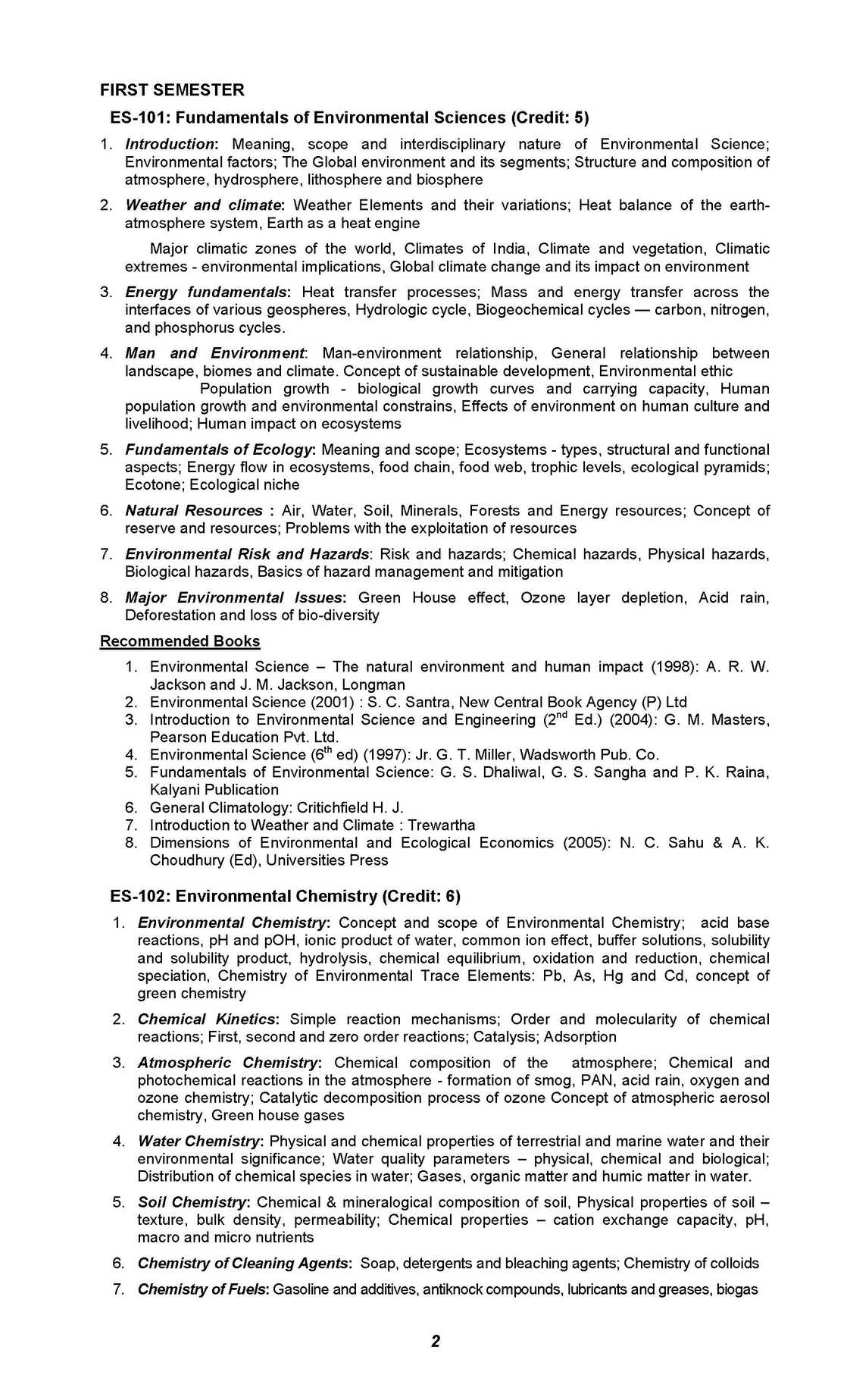

Capital Gains Tax Essay A capital gain (loss) is an increase (decrease) in the value of an asset, such as that realized from the sale of stocks, bonds, precious metals, and property. Since a capital gain is an addition to economic wellbeing, theoretically it should be included in a comprehensive income tax base.