Capital and revenue expenditures multiple choice questions.

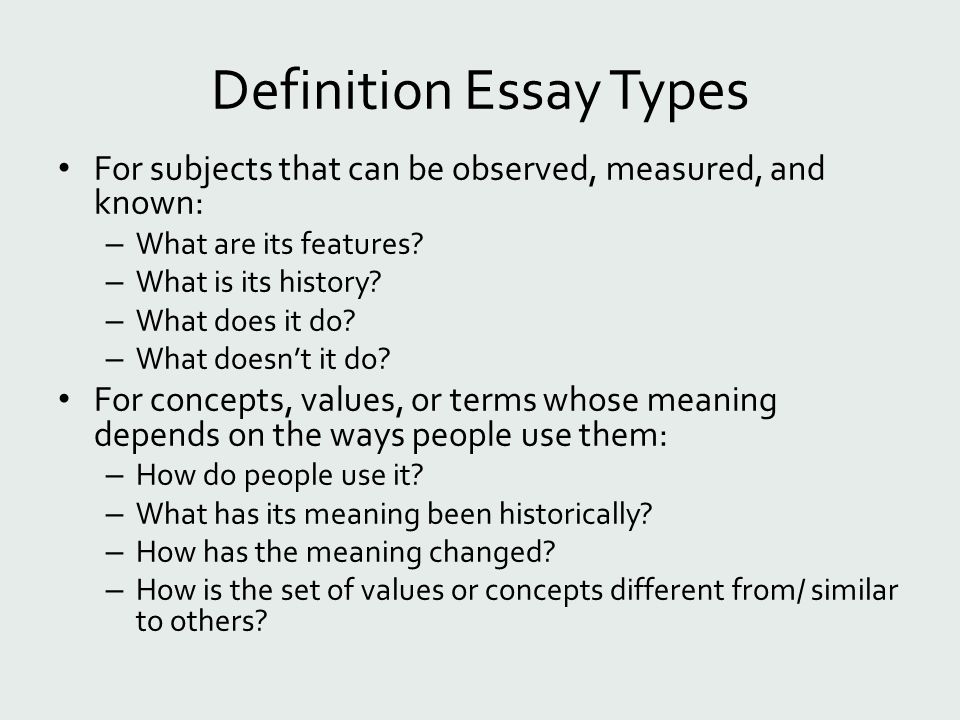

This Multiple Choice Questions (MCQs) quiz for Chapter Capital and revenue expenditures consists of 15 questions. Each question has 4 answers from which you need to choose the correct one. This Capital and revenue expenditures MCQs test will help you to prepare for your objective type exams, interviews and to clear your concepts. If you.The distinction between the nature of capital and revenue expenditure is important as only capital expenditure is included in the cost of fixed asset. Capital Expenditure. Capital expenditure includes costs incurred on the acquisition of a fixed asset and any subsequent expenditure that increases the earning capacity of an existing fixed asset.A capital expenditure is an amount spent to acquire or significantly improve the capacity or capabilities of a long-term asset such as equipment or buildings. Usually the cost is recorded in a balance sheet account that is reported under the heading of Property, Plant and Equipment.

Capital and Revenue Expenditure and Receipts. Welcome to “Capital and Revenue Expenditure and Receipts” topic. Before we explore this part of accounting study material at Accounting-Daddy.com, let’s examine what Cambridge wants us to learn under this title at secondary education level.Capital versus Revenue expenditure. 1. Definitions. a) CAPITAL EXPENDITURE is money spent to buy fixed assets. b) REVENUE EXPENDITURE is money spent on the daily running expenses of the business. 2. Examples of differences between Capital and Revenue expenditure. CAPITAL EXPENDITURE REVENUE EXPENDITURE. Purchase a building Rent a building.

Capital expenditures are for fixed assets, which are expected to be productive assets for a long period of time. Revenue expenditures are for costs that are related to specific revenue transactions or operating periods, such as the cost of goods sold or repairs and maintenance expense.Thus, the differences between these two types of expenditures are as follows.